#FutureOfFlight: GCC airports in expansion race as UAE, Saudi, Qatar, Kuwait, Oman spend billions of dollars on upgrades

Click on image to download high resolution version

Source: Arabian Business

Love at first sight is a real thing. Nothing makes a better impression than the first one, and that’s why airports are important. A well-managed and efficient airport is the best way to showcase the city – and the country – to the world.

Home to some of the finest airlines in the world, the Middle East is now planning to dominate the list of the world’s best airports as well.

In the 2024 World Airport Awards by SkyTrax, Hamad International in Doha moved one place above Singapore’s Changi to bag the top spot, while Dubai International made a massive jump of 10 spots to move to seventh place.

Dubai International, the busiest airport in the world in 2023, was voted second-best for 70+ million passenger airports, checking in after Tokyo Haneda. Hamad International was the best in the world for 40-50 million passengers. Bahrain and Muscat were Nos. 2 and 3, handling between 5 and 10 million passengers. Abu Dhabi and Amman were ranked fifth and sixth in the World’s Most Improved Airports list.

This wasn’t always the case. Even until the mid-1990s, most airlines viewed the Middle East airports as nothing more than technical stops.

What started with Dubai’s ambitions to become the world’s largest travel hub with the launch of Emirates Airline in 1985, has now spread across the Middle East. Countries want to take advantage of their strategic location and capture a bigger share of the long-haul market.

A recent OAG report on the Middle East aviation industry said: “The transformation can only be described as incredible, visionary in thought, near perfect in delivery, and resulting in the region becoming the centre of the aviation industry, linking nearly every major city in the world to at least one of the region’s major hubs. Four decades ago, many would not have believed the dream was possible. Today, that dream is reality, surpassing even the most optimistic expectations.”

The UAE and Qatar have led the aviation revolution in the region so far, but there is a new giant on the verge of joining, and possibly disrupting, the entire industry with its grand plans – Saudi Arabia.

As part of its Vision 2030, the Kingdom aims to attract 300 million air passengers by 2030 – almost three times the current estimated 107 million.

The UAE has its own ‘Tourism Strategy 2031’. Without specifying the number of tourists expected, the goal is to attract AED100 billion ($27.23 billion) in additional tourism investments and increase the number of hotel guests to 40 million. The strategy aims to raise the tourism sector’s contribution to the GDP to AED450 billion ($122.5 billion).

A key to executing such grand plans is for the country’s airlines is to have the capacity to handle the extra load. As of the end of 2023, the 10 largest airlines in the Middle East have placed a combined order of 795 aircraft to be delivered by the end of 2029—the largest order book in the world on a regional market basis.

A very natural corollary to this is the simultaneous upgrading of airports and increasing their capacities.

Here are some of the biggest airport infrastructure projects that are in the pipeline, or being executed right now…

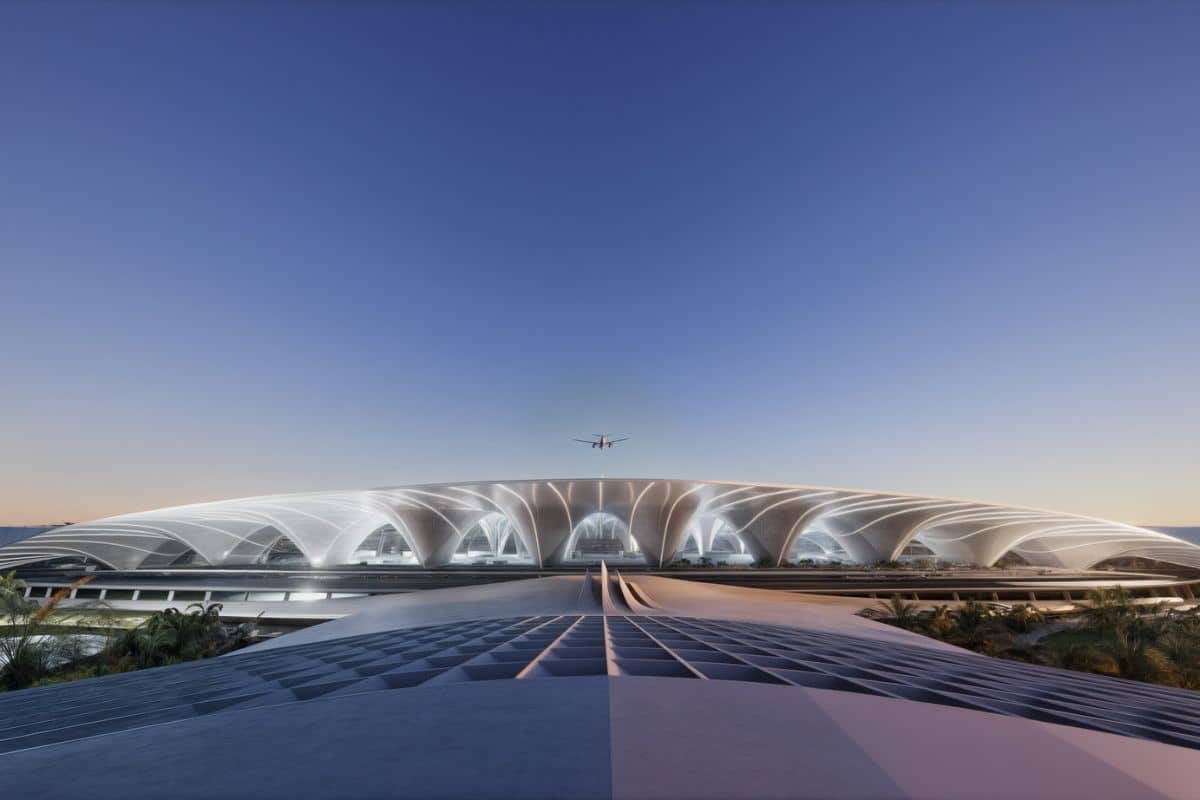

Al Maktoum International Airport | Dubai, UAE

Dubai is investing AED128 billion ($34.85 billion) in expanding the Al Maktoum International Airport, the emirate’s second airport. When complete, it will handle up to 260 million passengers annually — the largest capacity in the world.

In 2023, Dubai International Airport welcomed 86.9 million passengers.

The expanded Al Maktoum airport will feature 400 gates and five parallel runways. Once complete, it will be five times the size of Dubai International, and all operations will shift to the new airport eventually. It will cover 70 square kilometres in Dubai World Central area, and handle 12 million tonnes of cargo per annum once fully developed.

The first phase, which can accommodate 150 million passengers annually, will be completed within the next 10 years.

The second phase of the airport’s expansion, which was launched in 2010 and the current terminal inaugurated in 2013, will be divided into two sub-phases. The first sub-phase involves the construction of new terminal facilities, concourses, and satellite terminals, as well as the expansion of existing facilities. The second sub-phase will involve expanding and constructing more runways, site grading, roads and tunnels.

Two parallel, 4.5km-long Code F runways – the largest runways with sufficient distance between them to enable simultaneous operations – are being built as part of the first sub-phase. They will have CAT IIIB landing system.

A new 165,000 square metre terminal will be constructed at the west end of the airport, offering a capacity of 35 million passengers per year. Two satellite concourses, each with an area of 385,000 square metre and an annual capacity of 65 million passengers, will also be constructed. The airport’s four concourses will form a megastructure, covering a built-up area of 2.3 million square metre.

King Salman International Airport | Riyadh, Saudi Arabia

Announced in November 2022, Riyadh’s King Salman International Airport will be one of the largest in the world, covering an approximate 57 square kilometre area.

The airport will have six parallel runways and multiple terminals, including the existing terminals named after King Khalid. A 12 square kilometer area has been allocated for airport support facilities, residential and recreational facilities, retail outlets, and other logistics real estate.

Designed by Foster + Partners, the airport aims to accommodate up to 120 million travellers by 2030. It targets to handle 185 million travellers by 2050 and process 3.5 million tons of cargo.

The designers plan the airport to “become a dynamic aerotropolis centred around a seamless customer journey, world-class efficient operations, and innovation. Riyadh’s identity and the Saudi culture will be taken into consideration in the airport’s design to ensure a unique travel experience for visitors”.

Read Sea International Airport | Read Sea Project, Saudi Arabia

Inspired by the colours and textures of the desert landscape, the Red Sea International Airport is another Foster + Partners design and is set to become operational by the end of 2025. The airport is expected to reach a capacity of one million passengers travelling to the Red Sea Project tourism development by 2030.

The airport, which will be powered 100 per cent by renewable energy, will consist of five dune-like pods arranged radially around a central drop-off and pick-up space. Each pod will act as a mini terminal containing a departure lounge. The spaces between the pods will be filled with greenery.

Two wings will extend from either side of the main terminal and will house the airport’s ancillary spaces, including hangers, logistics bags, and baggage handling facilities. It will also have a dedicated seaplane runway and three helipads.

Abha International Airport | Aseer region, Saudi Arabia

Abha International Airport, the fifth-largest airport in Saudi by passenger traffic, is undergoing a massive expansion plan that is expected to be completed by 2028.

The first phase includes developing a new terminal that would increase the capacity almost nine times to 13 million passengers annually from the current 1.5 million.

India’s GMR Airports Limited, Turkish Mada TAV consortium, Incheon International Airport and Dar Al Handasah Consultants are some of the international organisations that have bid to undertake the terminal development under a public-private partnership. The selected company will be responsible for the airport development and operation for 30 years.

The expansion will increase the terminal space from its existing 10,500 square metre to 69,400 square metre in the first phase and to 73,200 square metre in the second phase. The new terminal will feature 20 gates.

The design of the new terminal will reflect Aseer area’s architectural heritage and draws inspiration from the Rijal Almaa village, a UNESCO World Heritage Site.